The Federal budget was announced last night and as always, it came with a lot of political babbling and technical terminology. We’ve bullet pointed the main areas that were addressed in the announcement. Stay tuned for a more thorough explainer on the personal and business effected areas next week.

Small Business:

- $20k asset write off, now extended to small business entities up to $10 mil. This measure has been extended until 30th June 2018.

- Increase in the small business entity aggregated turnover threshold to $10 mil from 1st July 2016 – but the threshold for accessing the CGT small business concessions remains at $2 mil.

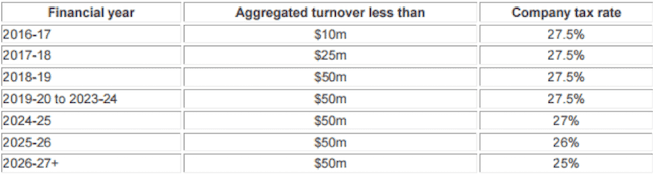

- Businesses with a turnover of up to $50 mil will receive tax cuts over the next few years (see below). Gap between marginal tax rate of individuals and company tax rate still widening. Incorporate now!

- From March 2018, there is an annual temporary work visa levy of $1,200 or $1,800 (dependant on turnover) per worker per year, and one-off permanent skilled visa levy of $3,000 or $5000 (dependant on turnover) to be paid by businesses employing these workers.

- There is an amendment to the small business CGT concessions to ensure that the concessions can only be accessed in relation to assets used in a small business, or ownership interests in a small business.

- The taxable payments reporting system (TPRS) currently applicable to the building & construction industry will be extended to contractors in the courier and cleaning industries from 1st July 2018.

Families:

- An increase to Family Tax Benefit has been scrapped. Childcare rebate has been extended, so that families with a combined income up to $185,710 no longer have a $10,000 cap on rebates.

- The Budget confirmed that, from 1st July 2017, Family Tax Benefit Part A supplement payments will be reduced by $28 per fortnight for each child not meeting the Government immunisation requirements.

Individual:

- Medicare rate increase of 0.5% across all individual tax payers, starting from 1st July 2019.

- The budget deficit levy of 2% on taxable incomes of over $180k will end 30th June 2017, therefore high income earners have effectively received a tax cut of 2%.

- First homeowner super saver scheme. You can now salary sacrifice $15k per year ($30k in a lifetime) into super, which can then be withdrawn later for use on a house deposit. Starts from 1st July 2017, and withdrawals start from 1st July 2018. Contributions and earnings will be taxed at 15%, withdrawals taxed at marginal tax rates less a 30% offset. We aren’t sold on this one. It may only drive house prices up, with no change to supply, only increased demand.

- Downsizer scheme, for people 65 years and over, allowing extra $300k non-concessional contribution into super from the proceeds of sale of main residence- which they have lived in for 10+ years. We this is a good measure which will promote an increase in supply. Ability for 2 people to do it, therefore it is possible to make a $600k non-concessional contribution for an eligible couple. It is exempt from age test, work test and $1.6 mil test. This comes into effect 1st July 2018. Note that the proceeds from downsizing a home in this manner are not proposed to be exempt from the Age Pension assets test.

- “Ghost tax” of up to $5k for foreign buyers failing to occupy or lease properties purchased in Australia.

- Proposed changes that will affect purchasers of newly constructed residential properties (or new subdivisions) who will be required to remit the GST directly to the Tax Office as part of settlement.

University Student:

- HECS/HELP debts to be repaid earlier, the threshold has dropped from $55k to $42k for when you must start repaying debt.

Rental Properties:

- No longer able to claim deduction for travel to visit rental property.

- Depreciation deductions for plant and equipment available to investors will be restricted from 1 July 2017 to where the costs have actually been incurred by the investors in residential real estate properties. This restriction will not apply to deductions in respect of existing rental properties, and existing plant and equipment forming part of residential investment properties as of 9 May will continue to provide deductions for depreciation until disposal or end of effective life.

- Increase to the capital gains discount to 60 per cent for investments in eligible affordable housing.

Pensioners:

- The Pensioner Concession Card has been restored to those who lost it after the pensioner asset test changes that came in on 1st January 2017.

- A one-off cash payment of $75 for individuals, or $125 for couples, to help with the winter power bills.

That’s a whole lot of info to take in. Are there any particular points you’d like us to expand on in the next post? Comment below! Or get in touch and we’ll happily take you through it.