Another year, another Federal Budget. Who will the winners and losers be? We’ve got the key areas you should be aware of as an individual, and a business owner. What the changes are, and what they mean for you.

Individuals

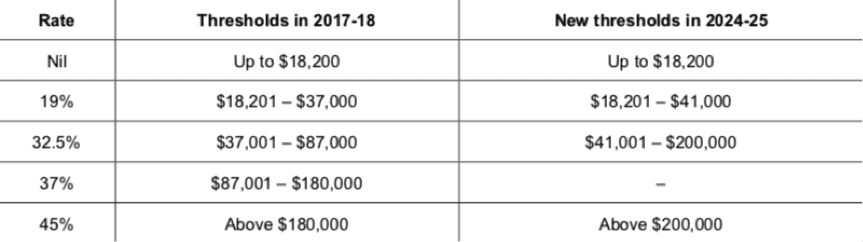

- A plan is being rolled out over the next 7 years targeting personal income tax, which will be implemented in 3 steps. As of 2024, the 37% tax bracket for earners between $87, 001 – $180,000 will be scrapped. See below for the full breakdown of the tax bracket changes.

- Medicare levy thresholds are increasing from $21, 655 to $21, 980 for individuals and from $36, 541 to $37, 089 for families.

- The Medicare levy will stay at 2% of your taxable income (there was talk of increasing it to 2.5%, which has been parked)

To refresh your memory… Medicare levy: essentially a tax that Australian income earners have to pay, which funds the public health system.

- If you are a low and middle income earner, you could be getting up to $530 extra in your pocket per year due to a new tax break, or the equivalent of roughly $10 per week. Two extra coffees!

- Retirees receiving the pension will be able to earn more pocket money, with an increase to a $300 wage per fortnight allowed, without effecting their pension payments.

Business

- The $20,000 instant asset write off that you enjoyed this financial year just got extended for another year. New computers for everyone! 😉

- The Victoria Budget announced there will be a change on payroll tax rates for businesses in regional areas, decreasing to 2.45% from 3.65%.

Superannuation

- The new budget is trying to make it easier for young people to manage their super fund. Exit fees will be scrapped, and they want to make finding and combining your old super accounts a far less painful process.

- The automatic life insurance policies that super funds currently come with will also be removed, for those younger than 25.

- From July 18, first homebuyers can withdraw any extra contributions they’ve made to their super fund since July 2017, in order to put a house deposit down.

Other things we found interesting…

- Cash payments of $10k or more will be made illegal.

- Tech giants such as Google & Facebook will be getting a big tax hike, in line with a crack down on the digital economy

- The black economy taskforce expects to bring in $5.3 billion in the next four years as a result of chasing businesses who underreport their cash income.

As always, the budget is a “might happen” situation- not a definite. Realistically some of these changes will come into play and some won’t. We’ll keep you updated along the way.

If these changes impact you, and you aren’t sure what it means for your business or personal financial situation, don’t hesitate to get in touch.