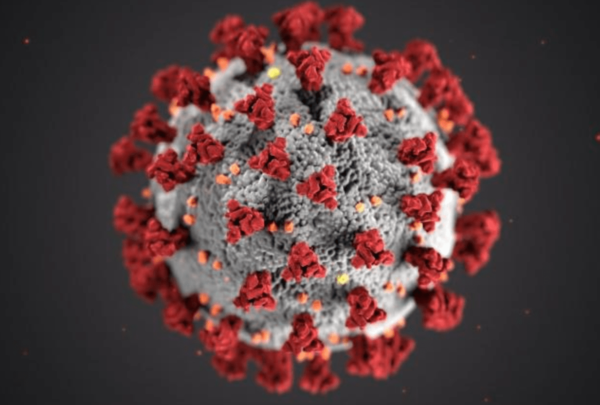

COVID-19 is all anyone’s talking about, and for good reason. Not only are we dealing with the biggest toilet paper shortage we’ve ever seen… we’re also in unprecedented times for Australia’s small businesses who are facing some of the biggest challenges to date. We need to look after each other, particularly the most vulnerable of our community now more than ever, which is why containment policies and procedures are so important to understand and take seriously. One of RBK Advisory’s core values is our community, and we want to do our best to assist all within it to be across the key issues, particularly those running businesses that may be affected the most from an economic standpoint.

Below is small business specific information which will assist our clients in preparing for, and navigating these challenging times. We have also provided guidance on the government’s recently announced economic assistance for small business, including links for more information and relevant facts sheets.

Here are some things you can do to prepare for the potential impact of coronavirus on your small business:

- Stay abreast of the fast changing environment your business is now in, including global and local corona virus releases, and industry announcements. Continually monitor relevant sources. Keep up to date with the latest alerts here:

- Put appropriate plans in place – understand your business risks and potential disruption. Draft a management plan for your business. You may also be required to prepare a specific COVID-19 management plan if your business works on sites other than your own place of business.

- Prepare for disruption. Review supply chains and/or service providers that your business may depend on. What would happen if these suppliers were disrupted?

- Educate and encourage healthy behaviours within your own team. Employers are required to have appropriate control measures in place, and these should be clearly communicated to staff with direction and guidance in regards to:

- employees should know when to stay away from the workplace

- what action to take if they become unwell, and

- what symptoms to be concerned about

- Prepare for a time when staff may have to work from home for quarantine isolation/containment reasons. How may they continue to remain connected/productive?

- Review cashflow budgets, projections, forecasts. An economic slowdown can directly affect these matters. Cut costs where possible – make your business as robust as it can be. If you do begin to suffer losses, check with your insurance policies – are you eligible for a claim under the policy due to business disruption?

- Communication is key – communicate with customers, suppliers, staff, banks if necessary… ALL key stakeholders. Understand the issues within the industry your business operates.

- Act locally as much as practically possible – this not only keeps us safer (e.g restrict any non-necessary travel), but it also assists to stimulate our local economy in these difficult times

Highlights for small businesses: The government’s $17.6b stimulus package to support businesses weathering disruption caused by COVID-19.

Business Investment stimulus:

- $700m to expand the instant asset write off scheme. The threshold has increased from $30k to $150k. The turnover threshold to qualify for this has increased from $50m to $500m. The instant asset write-off scheme will operate from announcement until 1 July 2020.

- Introduction of a time-limited 15-month investment incentive to support business investment and economic growth over the short-term, by accelerating depreciation deductions.

Many new businesses now qualify for the instant asset write-off.

Learn more from Treasury here, and click here for a fact sheet.

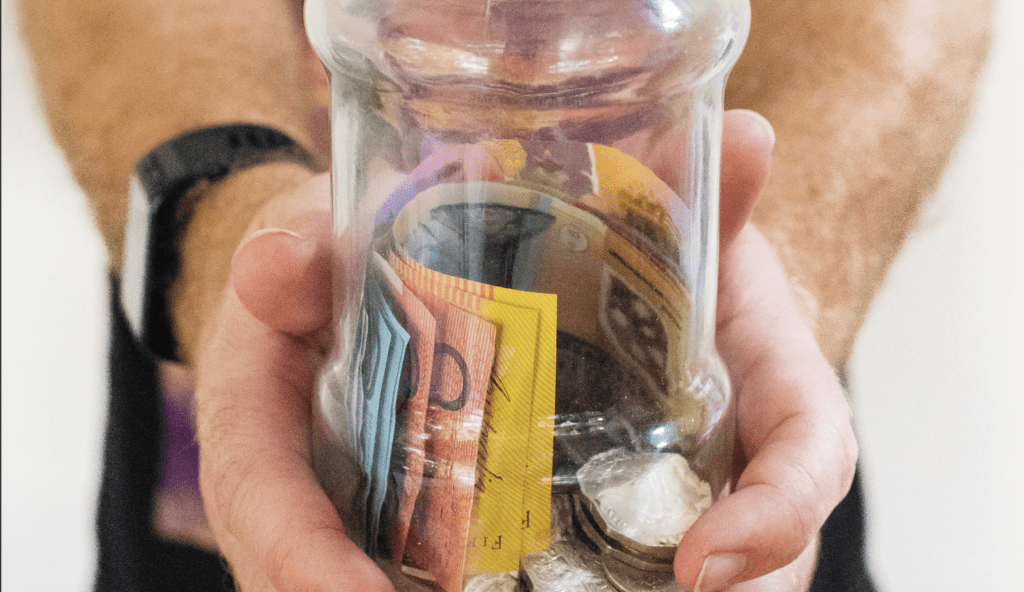

Cashflow assistance for small business:

- Businesses with turnover of up to $50 million will be eligible for tax-free payments equal to 50 per cent of PAYG withheld from salaries and wages, with a minimum of $2,000 and a maximum of $25,000 over six months.

- Businesses that pay salary and wages but are not required to withhold tax will also receive $2,000.

- This measure is expected to benefit 690,000 businesses employing 7.8 million people with a cost of $6.7b.

- The ATO will deliver the payment as a credit to the business upon lodgement of their activity statements. Where this places the business in a refund position, the ATO will deliver the refund within 14 days. Please note: our clients do not need to do anything. This will be handled by us and the ATO.

Cashflow assistance for the Workforce:

- $7000 each quarter in wage subsidies for employers of less than 20 people to save the jobs of 120,000 apprentices.

- Subsidies will be backdated to 1 January 2020 and will run until 1 September 2020.

- The Australian Tax Office (ATO) will provide administrative relief for certain tax obligations (similar to relief provided following the bushfires) for taxpayers affected by the Coronavirus outbreak, on a case-by-case basis.

For the Household:

- A one-off payment of $750 to social security, veteran and other income support recipients and eligible concession cardholders to support will occur. Over 90% of payments will be made by mid-April 2020.

- Deeming rates for pensioners will be cut by 50 basis points in response to the most recent decision of the Reserve Bank of Australia.

The Government has also included measures of support for regions and communities severely affected by the economic impacts of the virus.

Learn more about the sectors and regions here, with a fact sheet here.

The more informed you are, the better. Here’s some additional reading:

COVID-19 FAQs

Information for employers

Social distancing (including in the workplace)

As always, please feel free to contact us with your specific business queries. It’s business as usual on our end – one of the perks of being tech-driven! Video meetings can be set up so there’s no need for face-to-face. Get in touch to chat about how coronavirus will affect your business here.